Rate Disparity Book: Difference between revisions

| (79 intermediate revisions by the same user not shown) | |||

| Line 5: | Line 5: | ||

== Targeted vs Uniform Rate Increases == | == Targeted vs Uniform Rate Increases == | ||

There are two ways one | There are two basic ways one might go about "increasing interest rates". | ||

My thesis is that the most effective approach needs to be highly targeted: going after specific overextended balance sheets and finding overvalued assets, and hitting borrowers who use those assets as collateral, with rate increases on additional marginal borrowing, as well as margin calls to help cover the inevitable losses to the overvalued assets. Then these overextended entities, wherever they are in the financial hiearchy(governments > banks > firms > individuals), will either need to get their house in order, or they default and sell off their assets, correcting inflated prices. | |||

balance sheets and hitting | Importantly, this approach of targeted rate increases does not necessarily increase nominal interest rates and the risk free rate or risk adjusted rates of return. | ||

In contrast to this targeted and deliberate approach, the conventional approach to rate increases, is "non-targeted", and results in a uniform nominal increase to interest rates, resulting in higher "risk free", or risk adjusted rates of return. Whether and how asset prices are to correct after these nominal rate increases, is left primarily up to markets, the central bank does not take leadership in determining the overpriced and systemically destabilizing assets. | |||

This conventional passive approach relies on nominal rate changes inducing, or being coordinated with, even larger changes to real rates. It does not help that a very important class of assets: treasury securities or national debts, will now be issued at a higher nominal cost, which can itself fuel inflation or increase wealth inequality. Additionally, this approach results in the wrong balance sheets losing value: those that hold high quality assets like treasury bonds(high quality in that they are a near cash substitute), rather than those that hold riskier or speculatively overpriced assets. | |||

This uniform or "nominal focused" approach to increasing interest rates, involves | |||

mechanisms such as interest on reserves, and using the overnight rate, rather | mechanisms such as interest on reserves, and using the overnight rate, rather | ||

than looking at the long term health of assets. For political reasons, central | than looking at the long term health of assets, or trying to distinguish between bad and good assets. For political and historical reasons, central | ||

banks | banks favor this more indirect, arguably less effective approach. If this does not work, a uniform, nominal rate increase potentially | ||

ends up being a mere stock split: a continuous downward redenomination. | ends up being a mere stock split: a continuous downward redenomination. | ||

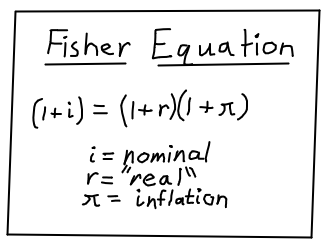

The fisher equation can be used to help analyze which ends up happening in a | The fisher equation can be used to help analyze which ends up happening in a | ||

particular scenario, whether | particular scenario, whether | ||

nominal rate increases | nominal rate increases lead to a regressive upward redistribution, or a unimpressive | ||

downward re-denomination. A | downward re-denomination. A simplistic reading of the fisher equation, would | ||

suggest that a plausible result is something in the middle: | suggest that a plausible result is something in the middle: | ||

a partial increase in real returns, and a partial increase in inflation: | a partial increase in real returns, and a partial increase in inflation: | ||

| Line 55: | Line 59: | ||

will use the term "real rate". | will use the term "real rate". | ||

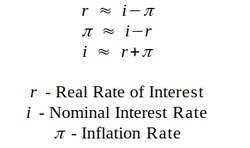

After initially writing down the fisher equation as the definition of the real rate of interest, with the real rate on the left hand side, and the other two variables on the right, let's now solve for the nominal rate, and move it to the left hand side, with the other two terms, inflation and the real rate, added together on the right hand side. With the nominal rate isolated, we can clearly see the range of potential responses to nominal rate changes. When the nominal rate is increased, the sum on the right hand side is increased by an equal amount. This means that with a nominal rate increase, either inflation or the real rate must increase. Both could increase by a lesser amount, or, if one increases by ''more'' than the change to the left hand side, then the other will decrease. As we see, this is exactly the conventional story of the effect of rate hikes. A nominal rate increase is expected to achieve an even greater increase to the real rate of interest, which means inflation decreases as a result. This is | After initially writing down the fisher equation as the definition of the real rate of interest, with the real rate on the left hand side, and the other two variables on the right, let's now solve for the nominal rate, and move it to the left hand side, with the other two terms, inflation and the real rate, added together on the right hand side. With the nominal rate isolated, we can clearly see the range of potential responses to nominal rate changes. When the nominal rate is increased, the sum on the right hand side is increased by an equal amount. This means that with a nominal rate increase, either inflation or the real rate must increase. Both could increase by a lesser amount, or, if one increases by ''more'' than the change to the left hand side, then the other will decrease. As we see, this is exactly the conventional story of the effect of rate hikes. A nominal rate increase is expected to achieve an even greater increase to the real rate of interest, which means inflation decreases as a result. This mathematical relationship is what we describe with the word "complements". It is just a way of saying that the real rate and inflation add up to the nominal rate, and an increase in one variable results in a decrease to the other variable, assuming the nominal rate is unchanged. If you recall from your high school geometry class, complementary angles add to 90 degrees. In this case, the real rate and inflation add up to the nominal rate of interest. | ||

In this conventional view of interest rates, it is supposed that nominal rate hikes | In this conventional view of interest rates, it is supposed that nominal rate hikes | ||

and cuts, lead to an even greater change to the real rate, and that inflation moves counter to this. In other words, the direction of causality of a rate hike is considered to be nominal++ to real++++ to inflation--. I am intentionally imitating a common notation used in programming languages called "post-increment" and | and cuts, lead to an even greater change to the real rate, and that inflation moves counter to this. In other words, the direction of causality of a rate hike is considered to be nominal++ to real++++ to inflation--. I am intentionally imitating a common notation used in programming languages called "post-increment" and | ||

"post-decrement" operators, because they are both a convenient shorthand and they are also "inline operators" which means the change to the variables happens after the statement executes, and not in the middle of evaluation. | "post-decrement" operators, because they are both a convenient shorthand and they are also "inline operators" which means the change to the variables happens after the statement executes, and not in the middle of evaluation. The notational convention of post-increment and pre-increment operators used in computer programming, is very reminiscent of the relatively confusing terminology used to distinguish expected and realized rates of inflation or interest. In economic terminology an expected rate is called the "ex ante" rate, while the realized rate is called the "ex post" rate. Which one of these rates you use and how you measure them makes a crucial difference in the analysis of the different monetary approaches presented here. | ||

I want to challenge the conventional story, and argue that | I want to challenge the conventional story, and argue that | ||

| Line 77: | Line 81: | ||

First, I wish to acknowledge this can be difficult to observe because of mean reversion. Rates are typically raised when inflation is high. So if inflation falls after a rate hike, that requires careful analysis to determine if the hike was in fact the cause of that decline. Furthermore, an even higher standard is required to show, even if there is a causal relationship, that it is not a pavlovian response or placebo effect. A pavlovian response happens when a treatment triggers a system response, based on the system's ability to learn and adapt to recurring coordinated treatments. A placebo effect, while a similar idea, is when the expectation a treatment will work, biases the final outcome. These possibilities are important to consider, because if one of them is responsible, then there may be an observable causal relationship, in the direction we want, and yet, alternative measures are potentially responsible for the observed effect, or alternative treatments could easily achieve a similar or greater desired impact. | First, I wish to acknowledge this can be difficult to observe because of mean reversion. Rates are typically raised when inflation is high. So if inflation falls after a rate hike, that requires careful analysis to determine if the hike was in fact the cause of that decline. Furthermore, an even higher standard is required to show, even if there is a causal relationship, that it is not a pavlovian response or placebo effect. A pavlovian response happens when a treatment triggers a system response, based on the system's ability to learn and adapt to recurring coordinated treatments. A placebo effect, while a similar idea, is when the expectation a treatment will work, biases the final outcome. These possibilities are important to consider, because if one of them is responsible, then there may be an observable causal relationship, in the direction we want, and yet, alternative measures are potentially responsible for the observed effect, or alternative treatments could easily achieve a similar or greater desired impact. | ||

Thus, merely establishing a causal relationship between a treatment and response is not enough. | Thus, merely establishing a causal relationship between a treatment and response is not enough. Without determining the mechanical reasons why that treatment works, it is difficult for us to understand when and how to apply it effectively. | ||

Meanwhile, economists often treat the interest rate setting as a universal medicine, applicable to any instance of inflation. While the dosage is debated, alternative prescriptions do not get a similar amount of consideration. | Meanwhile, economists often treat the interest rate setting as a universal medicine, applicable to any instance of inflation. While the dosage is debated, alternative prescriptions do not get a similar amount of consideration. | ||

So as we were discussing, it should be pretty clear from the fisher equation's arithmetic, that the nominal rate tool, must work with some degree of mechanical disadvantage, or amplification, in order to have the intended effect. By that I mean that changes in the nominal rate setting must lead to an even larger response in the change to real rates, or the rate hike's "tough medicine" can backfire, and have a zero or inverse effect on inflation. | So as we were discussing, it should be pretty clear from the fisher equation's arithmetic, that the nominal rate tool, must work with some degree of mechanical disadvantage, or amplification, in order to have the intended effect. By that I mean that changes in the nominal rate setting must lead to an even larger response in the change to real rates, or the rate hike's "tough medicine" can backfire, and have a zero or inverse effect on inflation. | ||

Amplified transmission would make sense under at least two scenarios: if markets are highly gullible, such as is the case with ponzi schemes, or they are highly obedient and the central bank's toolkit is powerful and respected. Neither possibility is very | Amplified transmission would make sense under at least two scenarios: if markets are highly gullible, such as is the case with ponzi schemes, or they are highly obedient and the central bank's toolkit is powerful and respected. Neither possibility is very convincing, if you look at how the financial system works at a basic level. | ||

Seeing as nominal rate changes are only a surface level outward change, they alone cannot be expected to increase asset performance, and so any effect would only be possible when paired with "real measures", such as enforcing financial defaults or stricter collateral standards, or fiscal restrictions, like higher taxes or implementing more disciplined and focused public spending priorities. If such real measures are commonly coordinated with the nominal change, or further, necessary for nominal changes to work, then we have a strong case for a merely pavlovian mechanism: the parallel real measures are doing the heavy lifting, and the nominal rate changes only serve as a coordinating signal. This would be fine, except that the nominal changes do create certain imbalances: the one time loss of present value to outstanding securities like treasury bonds, and the ongoing nominal cost or increased income share to new purchasers of these securities. | Seeing as nominal rate changes are only a surface level outward change, they alone cannot be expected to increase asset performance, and so any effect would only be possible when paired with "real measures", such as enforcing financial defaults or stricter collateral standards, or fiscal restrictions, like higher taxes or implementing more disciplined and focused public spending priorities. If such real measures are commonly coordinated with the nominal change, or further, necessary for nominal changes to work, then we have a strong case for a merely pavlovian mechanism: the parallel real measures are doing the heavy lifting, and the nominal rate changes only serve as a coordinating signal. This would be fine, except that the nominal changes do create certain imbalances: the one time loss of present value to outstanding securities like treasury bonds, and the ongoing nominal cost or increased income share to new purchasers of these securities. | ||

| Line 97: | Line 101: | ||

Once we look beyond the fed's bond market disrupting "guess what I'm thinking" game of interest rate setting, | Once we look beyond the fed's bond market disrupting "guess what I'm thinking" game of interest rate setting, | ||

there is a broader dynamic response based on the interaction on foreign exchange with the bond market. This response is often unpredictable or indeterminate for long periods of time, as it is mediated by markets and finance, relative to the entire domestic and foreign | there is a broader dynamic response based on the interaction on foreign exchange with the bond market. This response is often unpredictable or indeterminate for long periods of time, as it is mediated by markets and finance, relative to the entire domestic and foreign prospects of countries. This response plays a large role in determining the extent to which a nominal rate increase transitively leads to an increased real rate, but unlike other effects, it is a chaotic, market mediated, second order effect, whereas duration and targeting collateral appraisal are first order mechanical effects directly dictated by the practices of accounting, subject | ||

to the laws of balanced stock flow identities. | |||

While it is plausible for nominal rate increases to increase real rates by some amount, the possibility of amplified transmission, is neither | While it is plausible for nominal rate increases to increase real rates by some amount, the possibility of amplified transmission, is neither | ||

justified by theory nor clearly demonstrated in empirical work. While many papers have been published trying to measure the deflationary impact of rate hikes, the results are often inconsistent and leave room for questions. | justified by theory nor clearly demonstrated in empirical work. While many papers have been published trying to measure the deflationary impact of rate hikes, the results are often inconsistent and leave room for questions. | ||

One empirical paper you might want to evaluate, mentioned in the ''recommended readings'' section, is Romer and Romer: "A new measure of monetary policy shocks". The biggest question this paper raises for me, is that the effect of one of these interest rate "shocks", does not seem to be much shocking at all, as the response may require a lag of up to 2 years to have its intended effect. However, the most jarring claim I noticed from the paper, is that it optimistically reports a narrow confidence band for a shock's impact, even up to 4 years out. One would expect such a confidence band to increase greatly the more time which elapses from the initial change, as it becomes increasingly difficult to attribute the outcomes of that system, to the specific treatment, as the time from the change in the treatment variable increases. Either | One empirical paper you might want to evaluate, mentioned in the ''recommended readings'' section, is Romer and Romer: "A new measure of monetary policy shocks". The biggest question this paper raises for me, is that the effect of one of these interest rate "shocks", does not seem to be much shocking at all, as the response may require a lag of up to 2 years to have its intended effect. However, the most jarring claim I noticed from the paper, is that it optimistically reports a narrow confidence band for a shock's impact, even up to 4 years out. One would expect such a confidence band to increase greatly the more time which elapses from the initial change, as it becomes increasingly difficult to attribute the outcomes of that system, to the specific treatment, as the time from the change in the treatment variable increases. This divergent uncertainty, the sensitivity of a system to initial conditions, is a basic tenant of chaos theory: if you perturb the starting point of a system slightly, then it can dramatically alter it's evolution of state over time. Often referred to as the "butterfly effect", alluding to the idea that a butterfly flapping it's wings in one part of the globe, could modify the path of a hurricane years down the line, is a feature of many real world complex and interconnected dynamical systems, which may potentially apply to the changes of economic variables over time as well. | ||

For these paper's authors to assert such confidence in their assessment of counterfactual divergence, many years out, appears to indicate they reject the idea that the economy as a whole, or specifically its monetary credit systems, is a chaotic system in this mathematical sense. If the economy or monetary credit system does exemplify these aspects of chaos theory, that would mean the literature on monetary policy has made an unprecedented and astounding advancement in statistical identification methods. | |||

Either these authors are statistical wizards to see cause and effect clearly over a lag of four years, or the reported results represent some kind of very generous assumptions or dramatic simplification, and thus should be taken into consideration with a very healthy serving of salt. Regardless, even if we choose to reject these results and disagree with their conclusions, these efforts reflect a significant amount of academic labor and are representative more broadly of the consensus views of a significant body of credentialed academics. | |||

Contending with these claims in a satisfactory way requires much more than the comments I can make in this informal discussion, or my largely uncompensated and amature attempts at a high level exposition. Nevertheless, I would suggest that an accurate interpretation of the mechanical effects on accounting positions, is in my favor and calls into question these results. It was not clear to me at the least, how the paper's conclusions effectively accounted for the divergent uncertainty that arises in complex systems over time(chaos). Again, it appears the reported confidence bands for the response stayed optimistically tight even 4 years after the initial shock. | |||

Another important consideration is that much of this empirical literature on rate hikes, starts with the assumption that they have some level of deflationary impact, and are thus focused on trying to measure this impact, rather than establish a direction of causality from a more neutral analytical perspective. If one is familiar with statistical methods of inquiry, your assumptions play a critical role in what kind of data you collect and how you evaluate it. In other words, the most informative test depends on where you expect the answer to be. If your theoretical model is too far off, it is very difficult to get useful information. | Another important consideration is that much of this empirical literature on rate hikes, starts with the assumption that they have some level of deflationary impact, and are thus focused on trying to measure this impact, rather than establish a direction of causality from a more neutral analytical perspective. If one is familiar with statistical methods of inquiry, your assumptions play a critical role in what kind of data you collect and how you evaluate it. In other words, the most informative test depends on where you expect the answer to be. If your theoretical model is too far off, it is very difficult to get useful information. | ||

=== Measuring | === Measuring Nominal Transmission Into The Real Rate === | ||

When empirically evaluating the impact of rate changes, the approach is typically | When empirically evaluating the impact of rate changes, the approach is typically | ||

| Line 122: | Line 133: | ||

While the dissent and contention in economics comes nowhere close to this level of stakes or legal persecution, there are some parallels. There is a lot of prestige in the field of economics, and rather than coming across as the renegades fighting to overturn centuries of ignorance with new ideas, mainstream economists, much like their theory of value, are focused on marginal or incremental gains. Whether you consider this incremental traditional approach to be a good idea, depends a lot on how you view the history of economic theory, and the level of confidence you have in the existing mainstream status quo. There is a strong case that the historical record of the economics profession is not great, and that the ideas that end up winning have usually been outsider alternative viewpoints. | While the dissent and contention in economics comes nowhere close to this level of stakes or legal persecution, there are some parallels. There is a lot of prestige in the field of economics, and rather than coming across as the renegades fighting to overturn centuries of ignorance with new ideas, mainstream economists, much like their theory of value, are focused on marginal or incremental gains. Whether you consider this incremental traditional approach to be a good idea, depends a lot on how you view the history of economic theory, and the level of confidence you have in the existing mainstream status quo. There is a strong case that the historical record of the economics profession is not great, and that the ideas that end up winning have usually been outsider alternative viewpoints. | ||

In some respects, the economic world we live in today is a very new one, based on | In some respects, the economic world we live in today is a very new one, based on constant changes to law and politics, which shape the design of the financial system. A critical example is how commodity standards like gold were repeatedly adopted and abandoned in financial history. When the chicken farmer and agricultural economist George Warren encouraged FDR to suspend the gold standard, prominent economists of the day railed against it as heresy. In many ways modern economics is still playing a game of catch up, trying to figure out what this chicken farmer saw that the rest of the world didn't. | ||

Today, other than the austrian school, fiat currency is accepted as the new "gold standard", the best tool for public finance. And we have a new "Warren" who is telling us once again to try something radical. | Today, other than the austrian school, and a few outliers(one might consider looking into the work of German Post Keynesian economist Wolfgang Stützel), fiat currency is accepted as the new "gold standard", the best tool for public finance. And we have a new "Warren" who is telling us once again to try something radical. | ||

Just like George Warren was a unconventional or even heretical outsider in the world of finance and economics, Warren Mosler is equally unconventional, demonstrating as much passion and creativity for engineering cars and catamarans, as he has for promoting unconventional interest rate policies and new economic ideas. | Just like George Warren was a unconventional or even heretical outsider in the world of finance and economics, Warren Mosler is equally unconventional, demonstrating as much passion and creativity for engineering cars and catamarans, as he has for promoting unconventional interest rate policies and new economic ideas. | ||

| Line 142: | Line 153: | ||

While I think such statistical and empirical work is incredibly important, it is very difficult and potentially has a short shelf-life. The "Lucas Critique", suggests some possible reasons why previous empirical studies may not be applicable to future scenarios, but I think there are other reasons as well. Regardless, let's go back to discussing the relevant accounting ''mechanics'' rather than the complex, unpredictable, and often seemingly contradictory market ''dynamics''. | While I think such statistical and empirical work is incredibly important, it is very difficult and potentially has a short shelf-life. The "Lucas Critique", suggests some possible reasons why previous empirical studies may not be applicable to future scenarios, but I think there are other reasons as well. Regardless, let's go back to discussing the relevant accounting ''mechanics'' rather than the complex, unpredictable, and often seemingly contradictory market ''dynamics''. | ||

== The "Risk Free" Rate and Risk Adjusted Rates == | |||

No financial investment or asset is free from risk. What a risk free rate | |||

represents, is one of two possibilities:a nominal rate of return without any additional risk, compared to some underlying asset, or a theoretical risk adjusted rate of return | |||

=== "Risk Free" Financial Assets === | |||

A risk free financial asset is an asset offered by a specific issuer, which theoretically has no additional risks compared to another asset they offer. So it is not that the asset has zero risk overall, it is merely that asset holders are able to secure an additional return with no additional risk, compared to holding some other asset. | |||

Even so, true risk free financial assets are rare, but I believe a valid example is the "interest on reserve" now commonly offered by central banks and other entities. | |||

=== Prioritization Does Matter === | |||

Even assets issued by the same entity may involve different "prioritization", | |||

or other conditions, such as waiting until maturity for redemption or access. | |||

For example, companies may issue "preferred shares". These will often lack | |||

voting rights, but have a higher priority payout, similar to how debt | |||

claims are supposed to pay out before equity dividends. | |||

=== The Risk Free Rate as a Theory tool: Risk adjusted Returns === | |||

The other sense in which we can discuss a risk free rate, is as a theory concept and a reference point for measuring other financial assets. If an asset yields x% and has a risk of y%, then the risk free rate is merely (x-y)%. | |||

This concept is especially important in "Modern portfolio theory", which is based on the assumption that risks can be measured and investors have some relative preference between higher risk average rates of return, and more consistent "lower risk" returns. | |||

== The Mathematics of Price Discovery: Relative Value Paths == | == The Mathematics of Price Discovery: Relative Value Paths == | ||

| Line 266: | Line 303: | ||

view of interest rates, and alternative viewpoints, such as described here, which | view of interest rates, and alternative viewpoints, such as described here, which | ||

suggest positive correlations between the nominal rate of | suggest positive correlations between the nominal rate of | ||

interest and inflation. | interest and inflation. A nominal rate adjustment separates the rate of return on financial assets like government securities and reserve accounts, | ||

from the | from the price level of the currency as a unit of measurement. This potentially allows smoothing over financial disruptions, meaning the currency unit devalues in a smooth predictable manner, even if financial assets jump up and down more sporadically. In this | ||

case, rates would be increased to reduce the volatility of inflation, | case, rates would be increased to reduce the volatility of inflation, | ||

rather than achieve disinflation. The disinflation is then achieved | rather than achieve disinflation. The disinflation is then achieved | ||

| Line 324: | Line 358: | ||

Rate hiking with a commodity currency, such as a gold standard, | Rate hiking with a commodity currency, such as a gold standard, | ||

would not be done with the intent of achieving an economy wide | would not necessarily be done with the intent of achieving an economy wide | ||

"deflation". This is because the value of the the currency | "deflation" alone, but rather for two potentially similar reasons: to allow the rate bearing instrument issuer to better monopolize their reserve commodity, or to allow them to borrow more in real terms at the higher rate. | ||

Rate increases under a commodity standard are not the most direct approach to effect a change in money's price level. And there is a sense in which rate changes cannot effect any change to money's price. This is because the value of the the currency | |||

is already fixed to the commodity. So by definition there is | is already fixed to the commodity. So by definition there is | ||

no inflation or deflation in terms of that commodity as a price index. This is a case where it becomes important to distinguish between different definitions and indices of inflation. | no inflation or deflation in terms of that commodity as a price index. | ||

This is a case where it becomes important to distinguish between different definitions and indices of inflation. If we use another measure like CPI to assess inflation, then inflation is entirely a matter of the relative price of the commodity compared to other items. | |||

The most direct approach to change "money" purchasing power under a commodity standard, is simply to adjust the rate of conversion between the money unit or unit of account, and the commodity. Historically this has been known as "seignorage", when the ratio of the commodity to the accounting unit is decreased. | |||

=== Commodity Currencies still use "Fiat" tokens === | === Commodity Currencies still use "Fiat" tokens === | ||

| Line 351: | Line 391: | ||

in that it occurs across the entire system. It is a "run on money". This | in that it occurs across the entire system. It is a "run on money". This | ||

can have the effect of inducing rapid deflation, or a change of the | can have the effect of inducing rapid deflation, or a change of the | ||

commodity's price relative to other commodities. So while a commodity | |||

currency is price stable in terms of that commodity, it can be more | currency is price stable in terms of that commodity, it can be more | ||

difficult and costly to stabilize its relative price against other | difficult and costly to stabilize its relative price against other | ||

| Line 359: | Line 399: | ||

While a fiat currency is commonly described as being "unbacked", this | While a fiat currency is commonly described as being "unbacked", this | ||

is an inaccurate label. It is more accurate to say they lack a fixed | is an inaccurate label. It is more accurate to say they lack on demand redemption at a fixed | ||

conversion. Fiat currencies are involved in a system of taxation, | conversion rate. Fiat currencies are involved in a system of taxation, | ||

debt, and property, and can be used to pay taxes, settle legally | debt, and property, and can be used to pay taxes, settle legally | ||

binding claims such as torts, and purchase commodities on the open | binding claims such as torts, and purchase commodities on the open | ||

| Line 366: | Line 406: | ||

If a commodity token issuer fails to redeem their token for the underlying | If a commodity token issuer fails to redeem their token for the underlying | ||

commodity, they go into default. But a similar process exists for tax | commodity, they go into default. But a similar process of conversion exists for "unbacked fiat", only it happens at the point of taxation, or tax default, and not at a deposit window. | ||

To secure money to pay taxes, you provide some good, service or commodity, and | To secure money to pay taxes, you provide some good, service or commodity, and | ||

the commodities you own may be subject to forfeit if you fail to pay. So | the commodities you own may be subject to forfeit if you fail to pay. So | ||

instead of redeeming the tokens for commodities at a bank teller window, a | instead of redeeming the tokens for commodities at a bank teller window, a | ||

fiat currency allows you to avoid forfeiting commodities, goods, and other | fiat currency allows you to avoid forfeiting commodities, goods, and other | ||

property to the tax man, when he comes | property to the tax man, when he comes knocking. While the process may | ||

be very different, and the timing very different as well, it has the same | be very different, and the timing very different as well, it has the same | ||

effect: the value of something informational or representative, is "backed" | effect: the value of something informational or representative, is "backed" | ||

| Line 384: | Line 424: | ||

For this reason, the value of a fiat token is essentially what you must do | For this reason, the value of a fiat token is essentially what you must do | ||

to earn it, to pay | to earn it, to pay your taxes, or someone else's taxes indirectly through the market process. | ||

=== Multi-Commodity Fixed Currencies Are Possible But Annoying === | === Multi-Commodity Fixed Currencies Are Possible But Annoying === | ||

| Line 391: | Line 431: | ||

then you could simply use the same basket as reserves, assuming | then you could simply use the same basket as reserves, assuming | ||

they are not perishable. Multi-commodity standards are | they are not perishable. Multi-commodity standards are | ||

not a new idea, but | not a new idea, but it appears they fail to catch on, because the price is typically fixed to each item in the basket, rather than | ||

the complete basket itself. | the complete basket itself. | ||

A direct(one-to-one mathematically) multi-commodity currency reserve system would require a deposit of all | A direct(one-to-one mathematically) multi-commodity currency reserve system would require a deposit of all | ||

| Line 433: | Line 473: | ||

measurement, rather than simply the quantity of a money good available. | measurement, rather than simply the quantity of a money good available. | ||

One reason to use commodity index is that it can include perishables | One reason to use a commodity index is that it can include perishables | ||

and consumer goods, while it is difficult to use perishables as a reserve to defend currency prices. Also, as economic agents shift their patterns of consumption, commodities indices can be adjusted to better reflect the commodities that the economy uses. | and consumer goods, while it is difficult to use perishables as a reserve to defend currency prices. Also, as economic agents shift their patterns of consumption, commodities indices can be adjusted to better reflect the commodities that the economy uses. | ||

| Line 468: | Line 508: | ||

tax. | tax. | ||

=== Commodity Currencies | === Commodity Currencies Can Have Relative Price Inflation in Another Commodity Index === | ||

So we just discussed how gold is an extrinsically valuable commodity tax credit. | So we just discussed how gold is an extrinsically valuable commodity tax credit. | ||

| Line 494: | Line 534: | ||

money at interest, you are not merely promising that you will repay a | money at interest, you are not merely promising that you will repay a | ||

debt, but essentially are promising that the amount of that commodity | debt, but essentially are promising that the amount of that commodity | ||

in circulation will increase. This is true locally if not globally | in circulation will increase. This promise can be fulfilled either by literally increasing the stock of the commodity available, relatively by decreasing savings in the commodity, or virtually by increasing alternative savings vehicles denominated in the commodity. The final and easiest way to increase availability of a commodity to fulfill interest payment commitments is simply to decrease its relative value and price. Regardless of which of these paths is chosen to fulfill interest commitments, the financial availability of the commodity must increase. This is true locally if not globally | ||

at the level of the larger macro economy. | at the level of the larger macro economy. | ||

| Line 513: | Line 553: | ||

But for that rate to be sustainable, they must ultimately be able to extract | But for that rate to be sustainable, they must ultimately be able to extract | ||

more value from the foreign sector than the rate they promise to pay when | more value from the foreign sector than the rate they promise to pay when | ||

they borrow. | they borrow. Like all borrowing, this works because not all economic transactions are zero sum: often there are opportunities to save costs or increase wealth through coordination and trade. | ||

The second reason is domestic: to essentially monopolize reserves to | The second reason is domestic: to essentially monopolize reserves to | ||

push the price up higher, allowing you to spend more in relative terms | push the price up higher, allowing you to spend more in relative terms | ||

| Line 528: | Line 569: | ||

By pushing the price of an extrinsically valuable commodity higher and higher, a | By pushing the price of an extrinsically valuable commodity higher and higher, a | ||

monopolist of that commodity can emulate a true fiat currency, where spending | monopolist of that commodity can emulate a true fiat currency, where spending | ||

is only limited by things offered for | is only limited by things offered for sale in that currency. Whereas a fiat | ||

currency might tolerate some inflation when it expands real spending, a monopolist | currency might tolerate some inflation when it expands real spending, a monopolist | ||

of a commodity currency will generally do the opposite: pursue deflation, | of a commodity currency will generally do the opposite: pursue deflation, | ||

| Line 549: | Line 590: | ||

help suck up commodity so you can control its price over time. | help suck up commodity so you can control its price over time. | ||

If this were your only tool for retaining a gold monopoly, eventually it would fail, but | If this were your only tool for retaining a gold monopoly, eventually it would fail, but if it complements other tools like taxation or simply direct pillaging, an elevated interest rate can help you retain a monopoly over a commodity based currency. | ||

=== The Ponzi Race: the rush to monopolize reserves === | === The Ponzi Race: the rush to monopolize reserves === | ||

| Line 572: | Line 613: | ||

on how we think of the boundary created by the barrier | on how we think of the boundary created by the barrier | ||

of the balloon. Are we making the inside of the balloon bigger, | of the balloon. Are we making the inside of the balloon bigger, | ||

or the outside of the balloon | or the outside of the balloon smaller? | ||

=== Preventing inflation in a commodity currency requires maintaining scarcity === | === Preventing inflation in a commodity currency requires maintaining scarcity === | ||

| Line 585: | Line 626: | ||

then we would have to keep that thing scarce, limit it, and try | then we would have to keep that thing scarce, limit it, and try | ||

to keep the outside of the balloon, the real world, really small. | to keep the outside of the balloon, the real world, really small. | ||

This is | This is a problem, | ||

if you are able to make the commodity less necessary or more avaiable | if you are able to make the commodity less necessary or more avaiable | ||

through innovation or logistics, then it loses value, and doesn't work | through innovation or logistics, then it loses value, and doesn't work | ||

as a commodity very well. | as a commodity money very well. | ||

This leads to one of the paradoxes of commodity currencies: it should | This leads to one of the paradoxes of commodity currencies: it should | ||

be perceived as useful or valuable, but if you use something intrinsically | be perceived as useful or valuable, but if you use something intrinsically | ||

| Line 596: | Line 636: | ||

with primarily extrinsic value, like gold, tend to be used. | with primarily extrinsic value, like gold, tend to be used. | ||

=== It is | === It is not necessarily desirable if the valuation of a virtual commodity money keeps increasing, or increases too rapidly === | ||

Other than physical commodities like gold, it is possible to build a similar | Other than physical commodities like gold, it is possible to build a similar | ||

| Line 605: | Line 645: | ||

other cryptocurrencies in general. There are many potential uses and | other cryptocurrencies in general. There are many potential uses and | ||

applications of these systems, the most notable being gambling and market | applications of these systems, the most notable being gambling and market | ||

speculation and various scams: rug pulls, ponzi schemes, mlms, etc. A secondary possible use is micropayments and a low cost, globally accessible payment systems. | speculation and various scams: rug pulls, ponzi schemes, mlms, etc. A secondary possible use of virtual commodities or cryptocurrencies, is micropayments and a low cost, globally accessible payment systems. | ||

This second application might be compared to using cowrie shells as coins, and for | This second application might be compared to using cowrie shells as coins, and for | ||

| Line 621: | Line 661: | ||

While this is definitely worse in terms of usability than our current system, in | While this is definitely worse in terms of usability than our current system, in | ||

my opinion it is the strongest case for an actually beneficial system of virtual | my opinion it is the strongest case for an actually beneficial system of virtual | ||

commodities. The ambiguity in virtual commodities arises because they are | commodities. The ambiguity in virtual commodities arises because they are not | ||

necessarily a direct debt of the issuer(though you may choose to account for them | necessarily a direct debt of the issuer(though you may choose to account for them | ||

as such), but they still need to be controlled and managed by this issuer, or issuing | as such), but they still need to be controlled and managed by this issuer, or issuing | ||

process. | process. | ||

To my assessment, the only way that a virtual commodity | To my assessment, the only way that a virtual commodity | ||

| Line 633: | Line 672: | ||

discussed how taxes mean that fiat currency is still "backed" | discussed how taxes mean that fiat currency is still "backed" | ||

by commodities and other real wealth, by avoiding forfeiting | by commodities and other real wealth, by avoiding forfeiting | ||

them to the taxman | them to the taxman. Rather than redemption on demand to receive a reserve commodity, tax credits serve as a buffer allow you to retain your owned commodities and other real assets, when the taxman comes knocking. | ||

With far too much emphasis on the valuation and speculation aspect | With far too much emphasis on the valuation and speculation aspect | ||

| Line 641: | Line 680: | ||

spaces, whether digital or physical, it will continue to | spaces, whether digital or physical, it will continue to | ||

be difficult for these commodities to find a useful niche. | be difficult for these commodities to find a useful niche. | ||

And I am genuinely afraid that if they do succeed in the | And I am genuinely afraid that if they do succeed in the | ||

way many supporters imagine, as a wholesale replacement | way many supporters imagine, as a wholesale replacement | ||

| Line 656: | Line 694: | ||

managed to insert itself into some actually critical economic | managed to insert itself into some actually critical economic | ||

or financial function, and I don't see that going well. | or financial function, and I don't see that going well. | ||

If you fill a balloon with a little bit of air, and then manage | If you fill a balloon with a little bit of air, and then manage | ||

to suck away the atmosphere, the balloon will grow in size. I | to suck away the atmosphere, the balloon will grow in size. I | ||

| Line 673: | Line 710: | ||

interest rate of marginal real borrowing reaches infinity, | interest rate of marginal real borrowing reaches infinity, | ||

we can call the "credit limit in real terms". | we can call the "credit limit in real terms". | ||

What is unusual about borrowing under a commodity standard, | What is unusual about borrowing under a commodity standard, | ||

is that gross and net borrowing positions | is that there may be good reasons to distinguish between gross and net borrowing positions, as it allows you to more effectively control the commodities price, as well as manage its flows over time. | ||

=== Swing Buyers and sellers: Money is Always a monopoly === | === Swing Buyers and sellers: Money is Always a monopoly === | ||

While it may appear that fiat money | While it may appear that fiat money | ||

is a monopoly, but commodity currencies defy centralization, one way or another even commodity money ends up being controlled by an important "swing trader", (similar to how a swing voter decides an election) | is a monopoly, but commodity currencies defy centralization, it is often the case that one way or another, even commodity money ends up being controlled by an important "swing trader", (similar to how a swing voter decides an election), or in other cases an overt monopoly. | ||

or | |||

an | |||

The change from commodity money to fiat, may initially appear to be | The change from commodity money to fiat, may initially appear to be | ||

| Line 709: | Line 726: | ||

a physical commodity like gold? | a physical commodity like gold? | ||

=== The Credit Limit In Real Terms === | |||

, | At the credit limit, offering higher rates does not give you more purchasing power at the time of borrowing, it only increases the profits of your lenders and the costs you pay for financing. | ||

If we use an interest rate to measure the cost of borrowing | |||

or an unreciprocated net real spending position, then in | |||

an idealized model this marginal cost will eventually be infinite. However, with a flexible fiat currency, this credit limit actually happens much earlier, because the potential for inflation limits real purchasing power. | |||

The higher the rate, the more people will accept your instrument, | |||

to a point. But once you pass that point borrowing is only a greater external transfer of wealth. You are not able to buy more goods and services at the time of borrowing, you only pay more in interest. | |||

But this dynamic does not apply in the same way currency or equity issuers, who cannot face default or repossession, only a loss of support and losing the ability to buy more, as their share price falls to zero. But the critical tipping point is not when their share price falls, but rather when their total valuation decreases despite issuing more shares. Once issuing more currency or shares results in a decreased valuation for the aggregate of all currency or shares issued, that is when you have hit the "credit limit in real terms". | |||

When a conventional borrower reaches their credit limit, they have something to lose. But a currency or equity issuer merely has the price of their shares or currency fall, faster than they can issue more. Eventually currency or share price can fall to zero, and the entity ceases financial existence. | |||

a | |||

== Most Experts Agree Rate Hikes are Deflationary, But Are They Wrong? == | == Most Experts Agree Rate Hikes are Deflationary, But Are They Wrong? == | ||

| Line 745: | Line 748: | ||

and their history. But if the conventional view of interest rates is wrong, how and why did so many experts, including Mehrling, miss this? It is certainly not for a lack of intelligence, study, nor simply for the sake of conformity with traditional viewpoints. Many economists such as Mehrling challenge traditional narratives on many topics and ideas, and yet still support the consensus that rate hikes are more likely deflationary than not. Through an accomplished career as an academic and educator, Mehrling has demonstrated himself both knowledgeable and an expert communicator, as well as willing to challenge conventional mainstream ideas when he finds them wrong or misleading. There are countless other experts like Mehrling. The idea that nominal rate hikes are a deflationary tool, represents an overwhelming majority opinion, not only among mainstream economists, but it also appears to be the majority opinion among heterodox economists as well, who might otherwise argue against mainstream economic theory. | and their history. But if the conventional view of interest rates is wrong, how and why did so many experts, including Mehrling, miss this? It is certainly not for a lack of intelligence, study, nor simply for the sake of conformity with traditional viewpoints. Many economists such as Mehrling challenge traditional narratives on many topics and ideas, and yet still support the consensus that rate hikes are more likely deflationary than not. Through an accomplished career as an academic and educator, Mehrling has demonstrated himself both knowledgeable and an expert communicator, as well as willing to challenge conventional mainstream ideas when he finds them wrong or misleading. There are countless other experts like Mehrling. The idea that nominal rate hikes are a deflationary tool, represents an overwhelming majority opinion, not only among mainstream economists, but it also appears to be the majority opinion among heterodox economists as well, who might otherwise argue against mainstream economic theory. | ||

Just as a note for context, compared to other academic disciplines, the level of contending viewpoints in economics is very high, and I would suggest that while mainstream conventional theory represents a very dominant plurality(the most common opinion less than 50%), it falls short of a majority among credentialed experts. I don't have hard data on this, and would be open to correction, but one historical example of contending perspectives | Just as a note for context, compared to other academic disciplines, the level of contending viewpoints in economics is very high, and I would suggest that while mainstream conventional theory represents a very dominant plurality(the most common opinion less than 50%), it falls short of a majority among credentialed experts. I don't have hard data on this, and would be open to correction, but one historical example of contending perspectives is the cambridge capital controversy, which led to the "post-keynesian" school. But the conventional view of rate hiking has an unusually high support, both among many different schools of thought, and those of different political sentiments. So for us to contend with that opinion, we must make a strong argument, and furthermore attempt to describe how so many experts could get this point wrong. I do not consider it a comment on someone's merits or credentials to make a mistake on this matter, simply because it appears there are very good reasons for this belief, even though I am a dissenter to this common viewpoint. While many might be willing to entertain the idea that nominal rate hiking isn't a very effective or reliable tool for reducing inflation, there are very few who go so far as to argue the exact opposite, that nominal rate increases not only fail to reduce inflation, that they reliably increase it, especially if we compare this to a more direct approach of "price discipline". | ||

There are a few reasons why I want to discuss, and would encourage you to learn about, Mehrling's viewpoint of the economy. First of all, Mehrling is a credible academic and excellent at communicating his ideas. He does this in a way that is both | There are a few reasons why I want to discuss, and would encourage you to learn about, Mehrling's viewpoint of the economy. First of all, Mehrling is a credible academic and excellent at communicating his ideas. He does this in a way that is both | ||

| Line 931: | Line 934: | ||

this principle extremely well in his article "commodify the complement", which is why | this principle extremely well in his article "commodify the complement", which is why | ||

gaming companies sell consoles as loss leaders, or hardware companies sponsor open | gaming companies sell consoles as loss leaders, or hardware companies sponsor open | ||

source software. If a product or service being cheap or free, facilitates customers other products | source software. If a product or service being cheap or free, facilitates the creation of customers for other products and services, then you have an entirely different proposition to consider than a conventional cost/revenue/sales analysis specific to that service. (incidentally, | ||

this is very similar to the notion of externalities positive and negative, which is one | this is very similar to the notion of externalities positive and negative, which is one | ||

of the objectives of a government with regards to better accounting, government's financial parameter may be to do exactly those things which allow the public to save | of the objectives of a government with regards to better accounting, government's financial parameter may be to do exactly those things which allow the public to save | ||

| Line 1,766: | Line 1,769: | ||

political topics. But it must be acknowledged they are real and important. | political topics. But it must be acknowledged they are real and important. | ||

== Survival | == Survival is measured with "Ex Post" Rates, and it Affects Future Rate Strategies, in a Fractal Learning Pattern == | ||

Much of the conventional economic theory of interest rates focuses | Much of the conventional economic theory of interest rates focuses | ||

| Line 1,778: | Line 1,781: | ||

using new adaptations | using new adaptations | ||

or strategies. Thus the lifecycle | or strategies. Thus the lifecycle | ||

length of an entity, is important in | length of an entity, is important in how they determine expected rates of return. | ||

If one is merely looking at the discounted prices of assets, | If one is merely looking at the discounted prices of assets, | ||

compared to other assets in the | compared to other assets currently available in the market, then both | ||

mark to market wealth and price sensitivity(what would happen | mark to market wealth and price sensitivity(what would happen | ||

if you actually tried to sell all of an asset) will affect any | if you actually tried to sell all of an asset) will affect any | ||

| Line 1,789: | Line 1,792: | ||

Entities with long lifecycles will use a longer horizon for their | Entities with long lifecycles will use a longer horizon for their | ||

training information, | training information, | ||

which may | which may possibly be well suited to analyze a longer future | ||

discounting horizon. Entities with short lifecycles may be | discounting horizon. Entities with short lifecycles may be | ||

better suited to analyze short term trends, if their | better suited to analyze short term trends, if their | ||

| Line 1,800: | Line 1,803: | ||

The basic reason why post-hoc rates matter more, is because they assess who has survived from the last generation into this one! Expected rates quickly become irrelevant when the expectations of the past are destroyed, and a new set of survivors determine the future. | The basic reason why post-hoc rates matter more, is because they assess who has survived from the last generation into this one! Expected rates quickly become irrelevant when the expectations of the past are destroyed, and a new set of survivors determine the future. | ||

Post | "Ex Post" rates determine who has the means to continue investing in the future, and therefore are much more important factor in portfolio selection. | ||

== Yields cannot be assumed to be uniform for | == Yields cannot be assumed to be uniform for different scales of principle == | ||

The ephemeral nature of wealth and value, dictates that | The ephemeral nature of wealth and value, dictates that | ||

yields will always be highly sensitive to the amount of your principle | yields will always be highly sensitive to the amount of your principle: Are you investing $10, $10K, $10M, $10B, or $10T? | ||

Indeed. the challenge of wealth management, is a storage problem: | Indeed. the challenge of wealth management, is a storage problem: | ||

"can we anticipate and meet our future needs?" | "can we anticipate and meet our future needs?" | ||

| Line 1,816: | Line 1,819: | ||

unreasonable. This is also true of living organisms, larger organisms tend | unreasonable. This is also true of living organisms, larger organisms tend | ||

to grow more slowly and have a longer reproductive lifecycle period(doubling time). | to grow more slowly and have a longer reproductive lifecycle period(doubling time). | ||

== Wealth Storage and Marginal Returns (plus time horizons)== | == Wealth Storage and Marginal Returns (plus time horizons)== | ||

Latest revision as of 11:04, 2 March 2025

A technical yet informal exploration of novel interest rate ideas

Part Zero: How we all got interest rates backwards

Targeted vs Uniform Rate Increases

There are two basic ways one might go about "increasing interest rates". My thesis is that the most effective approach needs to be highly targeted: going after specific overextended balance sheets and finding overvalued assets, and hitting borrowers who use those assets as collateral, with rate increases on additional marginal borrowing, as well as margin calls to help cover the inevitable losses to the overvalued assets. Then these overextended entities, wherever they are in the financial hiearchy(governments > banks > firms > individuals), will either need to get their house in order, or they default and sell off their assets, correcting inflated prices. Importantly, this approach of targeted rate increases does not necessarily increase nominal interest rates and the risk free rate or risk adjusted rates of return.

In contrast to this targeted and deliberate approach, the conventional approach to rate increases, is "non-targeted", and results in a uniform nominal increase to interest rates, resulting in higher "risk free", or risk adjusted rates of return. Whether and how asset prices are to correct after these nominal rate increases, is left primarily up to markets, the central bank does not take leadership in determining the overpriced and systemically destabilizing assets.

This conventional passive approach relies on nominal rate changes inducing, or being coordinated with, even larger changes to real rates. It does not help that a very important class of assets: treasury securities or national debts, will now be issued at a higher nominal cost, which can itself fuel inflation or increase wealth inequality. Additionally, this approach results in the wrong balance sheets losing value: those that hold high quality assets like treasury bonds(high quality in that they are a near cash substitute), rather than those that hold riskier or speculatively overpriced assets.

This uniform or "nominal focused" approach to increasing interest rates, involves mechanisms such as interest on reserves, and using the overnight rate, rather than looking at the long term health of assets, or trying to distinguish between bad and good assets. For political and historical reasons, central banks favor this more indirect, arguably less effective approach. If this does not work, a uniform, nominal rate increase potentially ends up being a mere stock split: a continuous downward redenomination.

The fisher equation can be used to help analyze which ends up happening in a particular scenario, whether nominal rate increases lead to a regressive upward redistribution, or a unimpressive downward re-denomination. A simplistic reading of the fisher equation, would suggest that a plausible result is something in the middle: a partial increase in real returns, and a partial increase in inflation:

Much of the approach used by central banks today is done for historical and political reasons. There is a strong case that if we designed sovereign fiat monetary systems on a "whiteboard" from the ground up, we could come up with something a lot better. In the worst case, the conventional practice of nominal rate increases, according to a taylor styled rule, does little more than provide pretext for an arbitrary and senseless financial disruptions to bond prices. I'll cover more on this throughout the book in discussions of duration and public balance sheets.

The case for a positive mechanical correlation between nominal rates and inflation

There are three basic ways to order the terms in the fisher equation. We can solve for any one of the three variables, and reviewing each possible arrangement of terms can help us discuss various ideas about inflation and interest, and how they might be related. The fisher equation can be expressed exactly as a product or an equivalent sum of logarithms. Alternatively, it can be written approximately by simply adding and subtracting each variable representing a percentage rate of change, as shown here.

The way I like to remember the fisher equation, is as the definition of the "real rate". The term "real rate" is somewhat unfortunate, because it depends on creating a cpi inflation measure to serve as a reference frame. So there are many possible "real rates" depending on the basket of goods or metric you use to measure inflation. That's why I think the term "cpi adjusted rate" would be much better, or in the case of interest rates moving forward the "forecasted cpi adjusted interest rate". However, to stick with a very common convention, we will use the term "real rate".

After initially writing down the fisher equation as the definition of the real rate of interest, with the real rate on the left hand side, and the other two variables on the right, let's now solve for the nominal rate, and move it to the left hand side, with the other two terms, inflation and the real rate, added together on the right hand side. With the nominal rate isolated, we can clearly see the range of potential responses to nominal rate changes. When the nominal rate is increased, the sum on the right hand side is increased by an equal amount. This means that with a nominal rate increase, either inflation or the real rate must increase. Both could increase by a lesser amount, or, if one increases by more than the change to the left hand side, then the other will decrease. As we see, this is exactly the conventional story of the effect of rate hikes. A nominal rate increase is expected to achieve an even greater increase to the real rate of interest, which means inflation decreases as a result. This mathematical relationship is what we describe with the word "complements". It is just a way of saying that the real rate and inflation add up to the nominal rate, and an increase in one variable results in a decrease to the other variable, assuming the nominal rate is unchanged. If you recall from your high school geometry class, complementary angles add to 90 degrees. In this case, the real rate and inflation add up to the nominal rate of interest.

In this conventional view of interest rates, it is supposed that nominal rate hikes and cuts, lead to an even greater change to the real rate, and that inflation moves counter to this. In other words, the direction of causality of a rate hike is considered to be nominal++ to real++++ to inflation--. I am intentionally imitating a common notation used in programming languages called "post-increment" and "post-decrement" operators, because they are both a convenient shorthand and they are also "inline operators" which means the change to the variables happens after the statement executes, and not in the middle of evaluation. The notational convention of post-increment and pre-increment operators used in computer programming, is very reminiscent of the relatively confusing terminology used to distinguish expected and realized rates of inflation or interest. In economic terminology an expected rate is called the "ex ante" rate, while the realized rate is called the "ex post" rate. Which one of these rates you use and how you measure them makes a crucial difference in the analysis of the different monetary approaches presented here.

I want to challenge the conventional story, and argue that a nominal increase in rates cannot reliably or automatically lead to higher real returns, especially not a real change larger than the nominal change, which is required to achieve deflation. To expect any nominal rate increase to change the real rate of asset performance, by an equal or greater amount, would suggest two likely explanations: either markets are gullible, always willing to trust the promise of higher real returns, or they are very strictly controlled by the central bank, so that they have no choice but to respond to the nominal rate setting with an even greater change to real rates. If the real rate change only matches the change to nominal rates, then no change to inflation will occur.

Why Amplified Transmission Into Real Rates Is Unlikely

Amplified transmission is the term I am choosing to refer to an even greater change to real rates, induced by a given nominal rate change, over the counterfactual scenario. From the fisher equation, amplified transmission is required for rate hikes to achieve deflation. Here is why this possibility is unlikely in both theory and practice.

First, I wish to acknowledge this can be difficult to observe because of mean reversion. Rates are typically raised when inflation is high. So if inflation falls after a rate hike, that requires careful analysis to determine if the hike was in fact the cause of that decline. Furthermore, an even higher standard is required to show, even if there is a causal relationship, that it is not a pavlovian response or placebo effect. A pavlovian response happens when a treatment triggers a system response, based on the system's ability to learn and adapt to recurring coordinated treatments. A placebo effect, while a similar idea, is when the expectation a treatment will work, biases the final outcome. These possibilities are important to consider, because if one of them is responsible, then there may be an observable causal relationship, in the direction we want, and yet, alternative measures are potentially responsible for the observed effect, or alternative treatments could easily achieve a similar or greater desired impact.

Thus, merely establishing a causal relationship between a treatment and response is not enough. Without determining the mechanical reasons why that treatment works, it is difficult for us to understand when and how to apply it effectively. Meanwhile, economists often treat the interest rate setting as a universal medicine, applicable to any instance of inflation. While the dosage is debated, alternative prescriptions do not get a similar amount of consideration.

So as we were discussing, it should be pretty clear from the fisher equation's arithmetic, that the nominal rate tool, must work with some degree of mechanical disadvantage, or amplification, in order to have the intended effect. By that I mean that changes in the nominal rate setting must lead to an even larger response in the change to real rates, or the rate hike's "tough medicine" can backfire, and have a zero or inverse effect on inflation.

Amplified transmission would make sense under at least two scenarios: if markets are highly gullible, such as is the case with ponzi schemes, or they are highly obedient and the central bank's toolkit is powerful and respected. Neither possibility is very convincing, if you look at how the financial system works at a basic level.

Seeing as nominal rate changes are only a surface level outward change, they alone cannot be expected to increase asset performance, and so any effect would only be possible when paired with "real measures", such as enforcing financial defaults or stricter collateral standards, or fiscal restrictions, like higher taxes or implementing more disciplined and focused public spending priorities. If such real measures are commonly coordinated with the nominal change, or further, necessary for nominal changes to work, then we have a strong case for a merely pavlovian mechanism: the parallel real measures are doing the heavy lifting, and the nominal rate changes only serve as a coordinating signal. This would be fine, except that the nominal changes do create certain imbalances: the one time loss of present value to outstanding securities like treasury bonds, and the ongoing nominal cost or increased income share to new purchasers of these securities.

If parallel real measures are doing most of the work, then these disruptions and imbalances are an unnecessary or excessive cost, especially when large and aggressive nominal rate changes are performed, as suggested by the "Taylor Rule".

In the absence of such parallel measures, the suggested mechanism for rate hikes to work seems to be little more than a psychological hack that leads markets to second guess themselves and "reset" their expectations.

An expectations reliant approach for fighting inflation, might be compared to home team basketball fans trying to distract a disciplined free throw shooter. Just like these fans, an effect working only through the expectations channel would have limited potency which is entirely in the hands of another party. The expectations approach to fighting inflation, is not much different from the attention seeking acts of desperation performed by sports fans on the sidelines.

While markets are fallible, and the "wisdom of the crowd" doesn't always win, treasury bond markets tend to be dominated by particularly well researched and risk averse institutional investors, so the gullibility ponzi scheme explanation for this mechanical advantage, is easily ruled out. On the other hand, central banks are expected to act very neutrally and face intense political scrutiny and limitations, so the obedience hypothesis is also fairly unconvincing. It is not markets that obey the fed, but rather the fed which faces intense political pressures and scrutiny. Over time, as inflation gets worse and worse(potentially from the very medicine we use to fight it), the frustration may upset political equilibriums enough, so that both the fed and the fiscal authorities can take more aggressive "real action". One might go so far as to say that the entire reason the fed embraces the nominal rate setting and promotes its potency is because it is typically too limited and scrutinized to enforce decisive "real measures", as described previously in terms of appraising financial collateral, and scrutinizing balance sheets.

Without fiscal coordination, it appears the most aggressive fed action is simply using duration to devalue outstanding treasury bonds, by indirectly increasing the yields of newly issued treasury bonds through changes to the short term overnight rate. In other words, we can only reduce bond holder's present purchasing power, by offering new bond buyers even more future purchasing power. Alternatively, central banks could choose to eliminate bonds entirely and simply convert them all to short term interest bearing reserve accounts. The current bank term funding program, kicked off in march of 2023, demonstrates how the fed's actions on bond pricing and duration can be contradictory or inconsistent, as they attempt to thread a needle with just the right amount of financial instability to scare markets, but not enough to break them.

Once we look beyond the fed's bond market disrupting "guess what I'm thinking" game of interest rate setting, there is a broader dynamic response based on the interaction on foreign exchange with the bond market. This response is often unpredictable or indeterminate for long periods of time, as it is mediated by markets and finance, relative to the entire domestic and foreign prospects of countries. This response plays a large role in determining the extent to which a nominal rate increase transitively leads to an increased real rate, but unlike other effects, it is a chaotic, market mediated, second order effect, whereas duration and targeting collateral appraisal are first order mechanical effects directly dictated by the practices of accounting, subject to the laws of balanced stock flow identities.

While it is plausible for nominal rate increases to increase real rates by some amount, the possibility of amplified transmission, is neither justified by theory nor clearly demonstrated in empirical work. While many papers have been published trying to measure the deflationary impact of rate hikes, the results are often inconsistent and leave room for questions.

One empirical paper you might want to evaluate, mentioned in the recommended readings section, is Romer and Romer: "A new measure of monetary policy shocks". The biggest question this paper raises for me, is that the effect of one of these interest rate "shocks", does not seem to be much shocking at all, as the response may require a lag of up to 2 years to have its intended effect. However, the most jarring claim I noticed from the paper, is that it optimistically reports a narrow confidence band for a shock's impact, even up to 4 years out. One would expect such a confidence band to increase greatly the more time which elapses from the initial change, as it becomes increasingly difficult to attribute the outcomes of that system, to the specific treatment, as the time from the change in the treatment variable increases. This divergent uncertainty, the sensitivity of a system to initial conditions, is a basic tenant of chaos theory: if you perturb the starting point of a system slightly, then it can dramatically alter it's evolution of state over time. Often referred to as the "butterfly effect", alluding to the idea that a butterfly flapping it's wings in one part of the globe, could modify the path of a hurricane years down the line, is a feature of many real world complex and interconnected dynamical systems, which may potentially apply to the changes of economic variables over time as well.

For these paper's authors to assert such confidence in their assessment of counterfactual divergence, many years out, appears to indicate they reject the idea that the economy as a whole, or specifically its monetary credit systems, is a chaotic system in this mathematical sense. If the economy or monetary credit system does exemplify these aspects of chaos theory, that would mean the literature on monetary policy has made an unprecedented and astounding advancement in statistical identification methods.

Either these authors are statistical wizards to see cause and effect clearly over a lag of four years, or the reported results represent some kind of very generous assumptions or dramatic simplification, and thus should be taken into consideration with a very healthy serving of salt. Regardless, even if we choose to reject these results and disagree with their conclusions, these efforts reflect a significant amount of academic labor and are representative more broadly of the consensus views of a significant body of credentialed academics.

Contending with these claims in a satisfactory way requires much more than the comments I can make in this informal discussion, or my largely uncompensated and amature attempts at a high level exposition. Nevertheless, I would suggest that an accurate interpretation of the mechanical effects on accounting positions, is in my favor and calls into question these results. It was not clear to me at the least, how the paper's conclusions effectively accounted for the divergent uncertainty that arises in complex systems over time(chaos). Again, it appears the reported confidence bands for the response stayed optimistically tight even 4 years after the initial shock.